Huu Minh MAI (CEO of IFRC Indexes), My Phuong TA (CEO of BeQ Holdings)

Vietnam Women CEO Indexes – Ten years already

Mai Kieu Lien, Chairman and CEO of Vietnam Dairy Products Joint Stock Company (Vinamilk) and Pham Thi Viet Nga, Chairman of DHG Pharmaceutical Joint Stock Co, Ltd have been placed 27th and 31st in the Forbes Asia’s 2013 list of 50 Businesswomen In The Mix. Based on this newspaper article, IFRC Indexes has built, calculated, and published the Women CEO Indexes Series, following International Standard and which are one of the best performing indexes on the Vietnamese Equity market, and can become a underlying of index product like derivatives, funds, or ETFs.

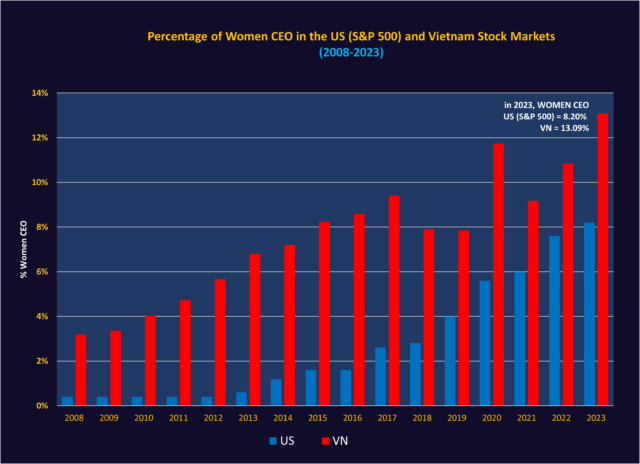

The Women CEO Benchmark index includes all companies listed on both Ho Chi Minh and Hanoi stock exchanges. The constituents of the two Women CEO 10 and Women CEO 25 indexes are selected among the best in free-float capitalization and liquidity to facilitate the transaction of the basket in the event of the index product. End of 2012, we identified 38 Vietnamese listed companies in the HOSE and HNX Stock Exchanges which are managed by female CEO. With 38/726 companies, i.e. 5.23%, this ratio places Vietnam in the top countries having the highest percentage of Women CEO, compared to 5% of CEO of S&P 500 are women.

Vietnam Women CEO Indices is the world’s first Women CEO Index, ushering in a new era.

Vietnam Women CEO indexes were launched in 2013, their history is recalculated backwards from 2008-12-31, and are available in Price version, and Total Return version (including dividends), and converted in several currencies (VND, USD, EUR, and JPY). In 2023, other currencies are available, such as SGD, CNY, HKD, AUD, CAD, and USDT, USDC Crypto currency anticipating the Global Extension of the Indexes Family.

IFRC Women CEO Vietnam Indexes Series comprise:

- IFRC VNX Women CEO index: All-Shares index, Quarterly Review, Full Capitalization weighted

- IFRC VNX Women CEO Equal Weighted index: All-Shares index, Quarterly Review, equally weighted

- IFRC VNX Top 10 Women CEO: Tradable index, Top 10 Largest Free Float Capitalization and Most Liquid

- IFRC VNX Top 25 Women CEO: Tradable index, Top 25 Largest Free Float Capitalization and Most Liquid

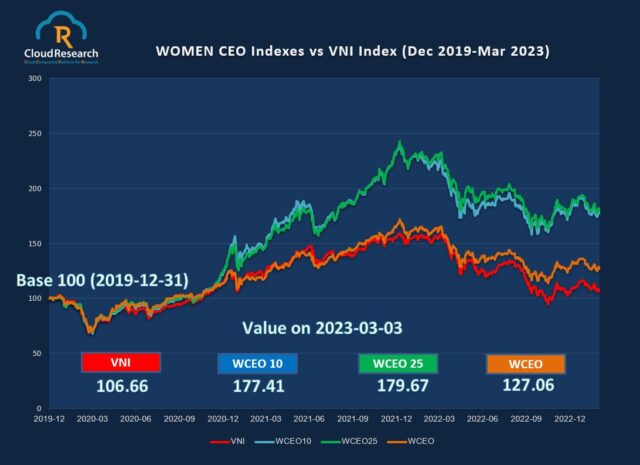

Their performances are impressive in comparison with the national indices calculated by the Vietnamese Stock Exchanges, such as VNI or HNX Indexes. Following a report of IFRC/BeQ Holdings Indexes, during the 2008-2023 period, the annual returns of the Women CEO All Shares, Women CEO Top 10, and Women CEO Top 25 are respectively 10.16%, 20.37%, 18.77%, compared to 8.66% of the VNI index, i.e., an excess return superior to 10% per year for 15 years. Women CEOs, although often very under-represented, sometime play the role of “firefighter” to resolve crisis situations, as certain research publications point out.

This research of IFRC/BeQ show Women CEO Indexes, including the All Shares and Tradable Top 10 and 25 versions, reportedly yielded better and much higher returns than the Vietnam Stock Index (VNI) between December 2019 and March 2023.

As from end of December 2023

The number of women CEOs in Vietnam’s listed companies has tripled from 39 in 2012 to a remarkable 110 in January 2024, representing a growth of 182%. This significant increase positions Vietnam as a global leader in female leadership within the corporate sector. Vietnam boasts a 15.07% share of women CEOs in listed companies, nearly double the rate of the US S&P index (8.20%). This rapid growth reflects a positive shift towards gender equality and diversity in Vietnamese businesses. This leadership advancement holds potential for improved corporate performance, innovation, and social impact.

As from December 2023, in considering the overall percentage women CEO in Vietnam Stock Markets (HOSE and Hanoi) 13.09%,

- Women CEOs hold a significantly higher representation on the Ho Chi Minh Stock Exchange (HOSE) compared to the Hanoi Stock Exchange (HNX), with 15.79% versus 9.79% respectively.

- Companies led by women CEOs tend to be more concentrated in the Mid Cap segment (17.80%) compared to Small Caps (12.29%) and Large Caps (11.54%).

- The Women CEO Index exhibits overweight positions in Healthcare (29.17%), Consumer Services (22.41%), and Financials (17.99%) compared to the market weight. Conversely, the index is underweighted in Oil & Gas (0%), Utilities (4.76%), and Industrials (6.78%).

- 23.16% of Women CEO are born in the Northern region, 12.63% in the Southern region, and 8.42% in the Central region; the other remaining percentage, the birth location is not available.

- Concerning the age of CEO, 34.74% of Women CEO age (among 69.47% data availability) in the 40-50 years old, compared to 28.21% of Men CEO (among 66.88% data availability) in the 50-60 years old.

Vietnam Women CEO indexes’ overperformance aligns with a growing trend of female-led companies outperforming the market globally.

IFRC Indexes and BeQ Holdings announce a significant expansion of the Women CEO Indexes, marking a pivotal step towards greater gender diversity and inclusivity in global corporate leadership.

Phase 1: Unveiling the Power of ASEAN+4 (Q2 2024)

Commencing in Q2 2024, the Indexes will extend their reach to encompass the dynamic ASEAN+4 region, including established and emerging economies like Vietnam, Indonesia, Philippines, Malaysia, Thailand, Singapore, and China/Hong Kong, Japan, Taiwan, South Korea. Leveraging collaborations with reputable universities and research institutions, the project will gather robust data and provide valuable insights into the performance and leadership styles of women-led companies in these diverse markets.

Phase 2: A Vision Beyond Borders, Expanding the Landscape of Influence and Catalyzing Positive Change (Q4 2024)

This initial phase serves as a steppingstone towards a comprehensive global Women CEO Index. By progressively incorporating additional regions and countries, the initiative aims to create a holistic picture of female leadership’s impact on corporate performance and market dynamics across the globe. The statement highlights the findings of a study comparing the performance of listed companies led by women in Vietnam and other countries. The results suggest that women-led companies tend to outperform their male-led counterparts in terms of financial metrics and other key indicators.

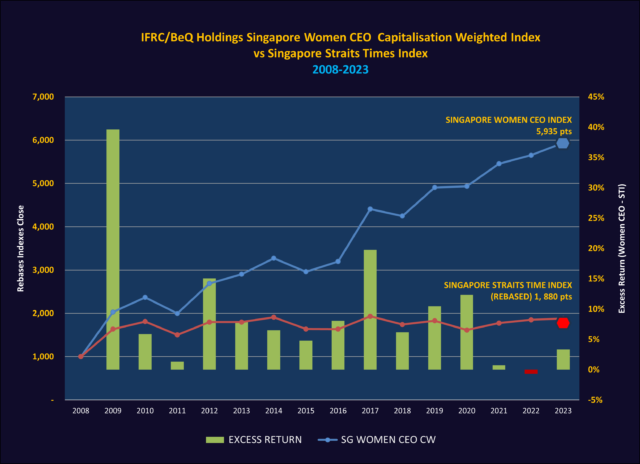

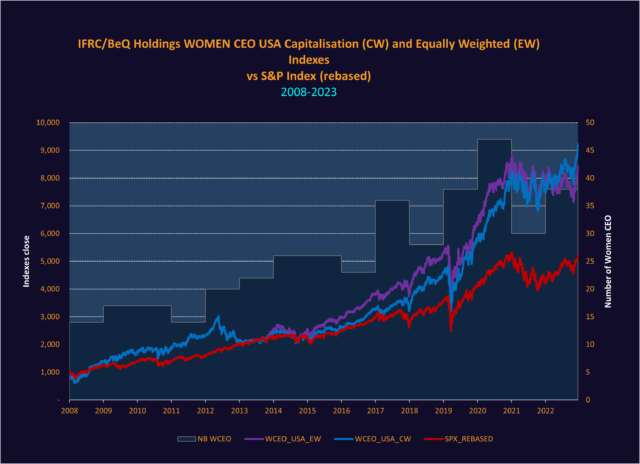

Over the period 2008-2023, the IFRC/BeQ Holdings Singapore Women CEO index and US Women CEO index outperform STI index and the S&P 500 index more than 9% and 5% per year respectively.

As of February 7, 2024, the combined Assets Under Management (AUM) of the three leading S&P 500 ETFs – SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 (IVV), and Vanguard S&P 500 (VOO) – stands at a staggering $1.3 trillion. This presents a significant potential opportunity for investors seeking to capture excess returns. By achieving just, a 5% annual outperformance compared to the S&P 500, the US Women CEO index could collectively generate an estimated $65 billion in additional returns every year.

Since the first launch of thematic IFRC WOMEN CEO/LEADERSHIP indexes in 2013, we have witnessed a surge in financial products of this theme in 2023:

- Invesco SHE ETF (SHE), 2016

- BNY Mellon Women’s Opportunities ETF (BKWO), 2017

- UBS Global Gender Equality UCITS ETF (GENDET), 2019

- Franklin FTSE Russell LGBT Inclusion UCITS ETF (FLGT), 2019

- Mackenzie Global Women’s Leadership ETF (MWMN), 2020

- Hypatia Women CEO ETF (WCEO): 2021

- SheGoes (SHE), launched in January 2023

- HER2 ETF (HER2), launched in February 2023,

- SPDR Gender Equality ETF (SHE), launched in March 2023

Academic research increasingly explores the link between women-led companies and superior market performance, especially in crisis periods.

Potential factors contributing to this trend include a more risk-averse approach, collaborative leadership styles, and investment in employee well-being. However, further research is crucial to understand the full picture and address potential industry or company size-related nuances.

Smarter Risk Management

Think of women leaders as the ultimate financial ninjas. Studies show they tend to take a more cautious approach to risk, avoiding overly risky ventures that can backfire during crises. Additionally, they often prioritize long-term sustainability over short-term gains, making their companies more resilient when things get tough.

Decisions with Everyone in Mind

Imagine a boardroom where everyone’s voice is heard and respected. That’s often the case in companies led by women, who tend to favor collaborative decision-making styles. This means incorporating diverse perspectives, leading to more informed choices, especially in uncertain times. Plus, their forceful communication and empathy skills help build trust and unity within the company, crucial for navigating challenges together.

Investing in People, not Just Profits

Forget the “work them hard, pay them low” mentality. Women-led companies are known for prioritizing employee well-being and development. This translates to happier, more engaged employees who are less likely to leave, even during rough patches. And let’s not forget diversity! By embracing diverse backgrounds and viewpoints, these companies foster innovation and adaptability, key ingredients for surviving and thriving in times of change.

While individual company success isn’t guaranteed, indices like our Women CEO Index offer diversified exposure to women-led companies, a sector exhibiting promising performance trends.

Our project delves deeper, investigating the complex factors beyond performance, aiming to provide data-driven insights into the potential advantages of women leaders in corporate governance. Through rigorous research and collaboration, we contribute to a more comprehensive understanding of female leadership’s impact on corporate performance and ultimately, support building more inclusive, equitable economies.